Landlord Controllable vs Non-Controllable Operating Costs | What Buyers & Sellers Should Know

boehm / January 13, 2026

What Commercial Property Buyers and Sellers Should Know

Landlord controllable vs non-controllable operating costs play a bigger role in commercial real estate than many owners realize. In practice, they do more than keep a property running—they directly influence outcomes such as:

Cash flow and Net Operating Income (NOI)

Property value and buyer underwriting

Investor confidence during due diligence

Vacancy rates

At a basic level, the distinction is simple. Some operating costs can be actively managed and improved, while others must be anticipated and clearly explained. Understanding this difference allows owners to:

Protect NOI through better expense control

Present cleaner, more credible listings

Evaluate opportunities with greater confidence

Reduce vacancy risk over time

Why Operating Expenses Matter

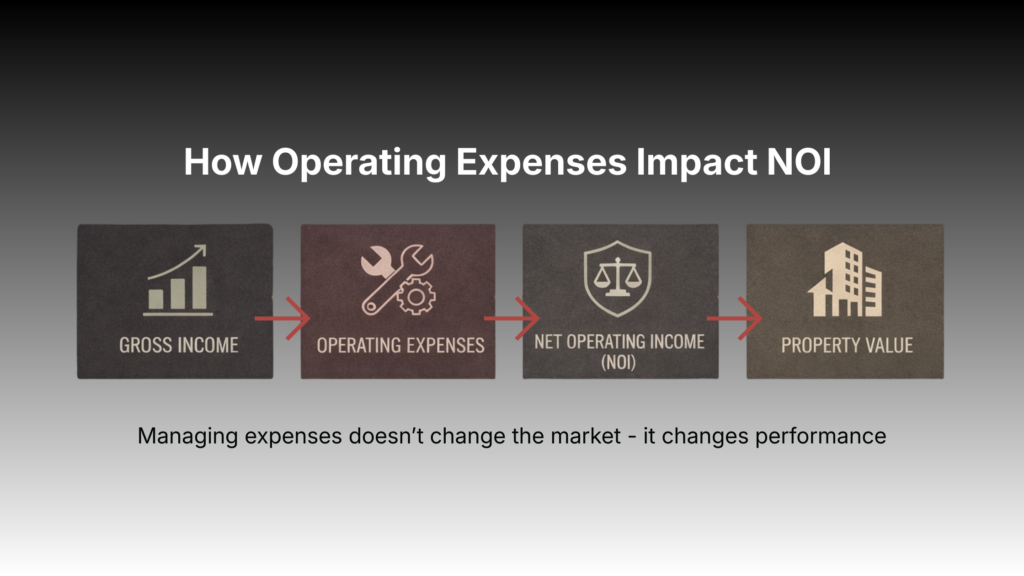

Commercial property value isn’t driven by income alone. Instead, it depends on what remains after operating expenses and how consistently that performance can be repeated over time.

From a buyer’s perspective, investors look beyond rent rolls to understand how a property operates in practice. Operating expenses help them evaluate efficiency, predictability, and potential risk—often revealing insights that headline numbers alone cannot.

When owners organize and clearly document expenses, they demonstrate strong stewardship and build confidence during underwriting. This clarity also impacts tenant confidence by reinforcing trust in ownership and management.

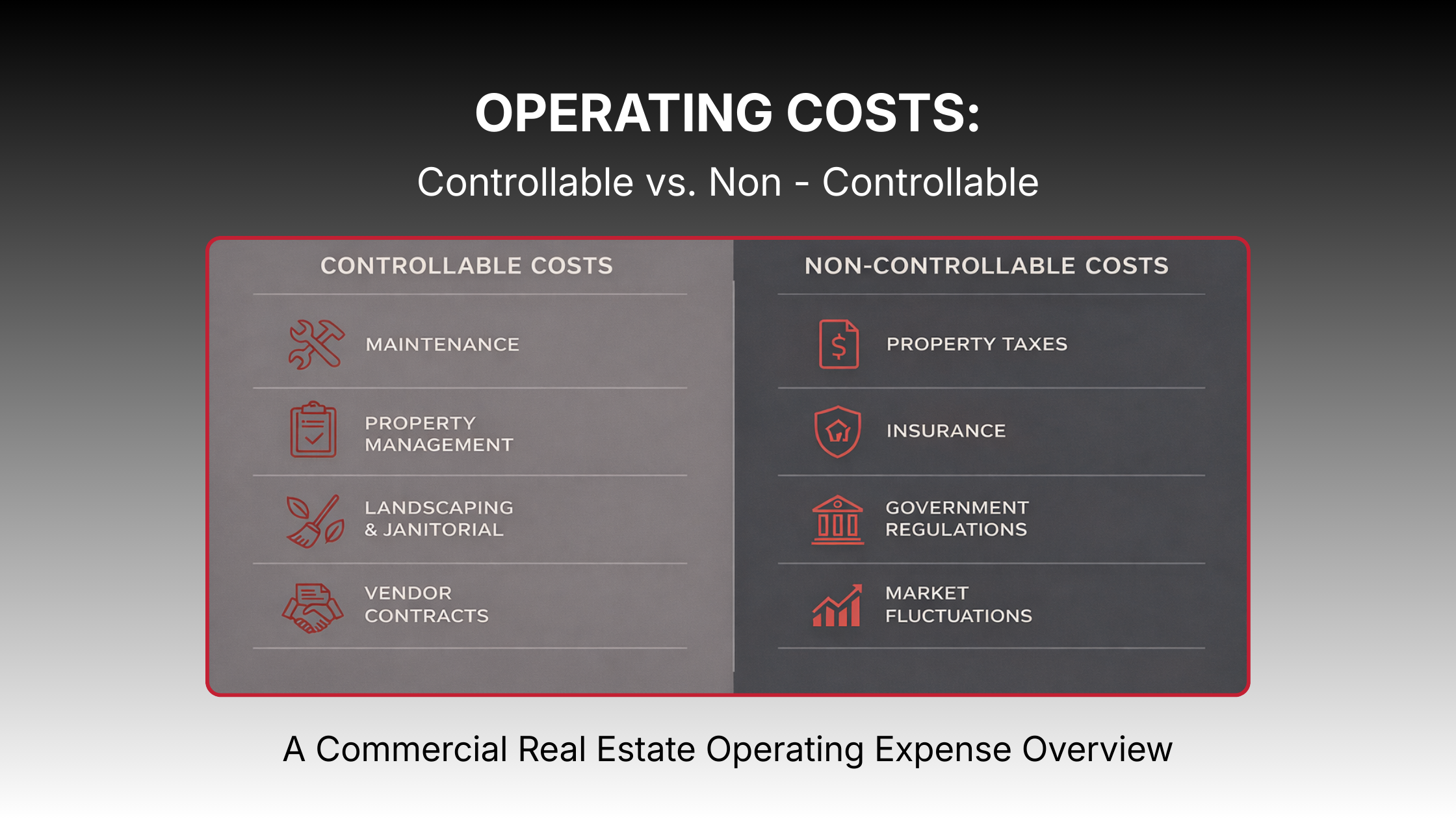

Controllable Costs: Where Owners Can Add Value

Controllable costs reflect decisions owners make through management practices, vendor selection, and oversight. These expenses show how a property operates day to day.

Common examples include routine maintenance and repairs, landscaping, janitorial services, property management fees, vendor contracts, security services, and certain utilities depending on lease structure.

For buyers, these expenses often highlight management quality and reveal potential upside. For sellers, consistent and well-documented controllable costs help support valuation and reduce friction during negotiations.

At the same time, tenants gain confidence when ownership manages controllable costs well. Strong oversight helps stabilize occupancy and reduces long-term vacancy risk.

Non-Controllable Costs: Market-Driven Realities

In contrast, non-controllable costs stem from external forces rather than ownership decisions. These expenses typically include property taxes, insurance premiums, government assessments, and utility rate increases.

Across Texas, many owners have experienced rising insurance and tax costs in recent years. Buyers generally understand this trend. What matters most is context and transparency, not perfection.

Clear records allow investors to assess risk realistically instead of relying on assumptions. Likewise, tenants expect ownership to actively protest tax assessments and review insurance policies to help manage overall occupancy costs. For properties structured under Triple Net leases, these non-controllable expenses directly affect reimbursements and underwriting—topics we break down further in our post,Triple Net (NNN) Leases in Boerne, TX: What Owners & Tenants Should Know.

How These Costs Affect Property Value

In simple terms, controllable costs reflect management quality, while non-controllable costs reflect market conditions. Together, they shape NOI—and NOI influences value.

For this reason, buyers typically review multiple years of operating history, tax and insurance trends, vendor agreements, and lease language related to expense pass-throughs. The goal extends beyond understanding today’s costs. Investors want to evaluate future reliability and consistency.

What Buyers and Sellers Should Focus On

Buyers prioritize clarity, consistency, and realistic assumptions. Meanwhile, sellers who prepare early often experience smoother transactions and stronger negotiating positions.

Preparation usually includes organized financials, clearly separated controllable and non-controllable expenses, and documented repairs or vendor agreements. In growth markets, that level of clarity can create a meaningful advantage.

A Texas-Focused Perspective

Texas continues to attract investment, but growth brings change. Insurance volatility, tax reassessments, and rising replacement costs now define part of the landscape.

These pressures do not signal management failure. Rather, they reflect market realities. Owners who explain them clearly and document trends tend to stand out during buyer review.

Key Takeaways

Some operating costs can be managed; others must be anticipated and explained clearly.

Controllable expenses signal management quality and impact NOI performance.

Non-controllable expenses reflect market conditions and require transparency.

Organized expenses build buyer confidence and support smoother underwriting.

Strong NOI supports value, and trust in the numbers drives decisions.

How We Help

Whether you’re buying, holding, or preparing to sell, the right commercial advisor brings clarity and confidence. Our team works alongside property owners and investors to navigate expenses, market shifts, and long-term strategy—helping you make informed decisions with purpose and transparency.

If operating expenses, NOI, or market shifts are influencing your next real estate decision, Boehm Commercial Group is here to provide clarity and strategic guidance.

Your Trusted Real Estate Partner

Whether you’re looking for a top real estate agent for commercial needs or exploring opportunities with reputable commercial real estate companies, we are your dedicated partner. Reach out to our team today, and let’s discuss how you can become part of San Antonio’s promising growth story and leverage these developments as catalysts for your next investment.

« Previous