Unlock the potential of distressed communities through strategic investments.

The Opportunity Zone Program, established by the Tax Cuts & Jobs Act of 2017, is designed to stimulate economic development in struggling communities across the U.S. Boehm Commercial Group is poised to help investors navigate these zones, maximizing both their financial benefits and community impact.

Understanding the Opportunity Zone Program

The federal initiative administered by the U.S. Department of Treasury offers significant tax incentives for investments in Qualified Opportunity Zone assets. Boehm Commercial Group’s expertise will help you fully understand these benefits.

Significant Tax Incentives

Investing in Qualified Opportunity Zones offers substantial tax benefits, including deferral of capital gains taxes on previously realized gains reinvested in a Qualified Opportunity Fund (QOF). Investors can reduce their capital gains tax liability based on the duration of their investment. Additionally, holding an investment for an extended period may allow for complete exemption from capital gains taxes on profits earned from the QOF investment. These incentives enhance financial returns while driving economic growth in underserved communities.

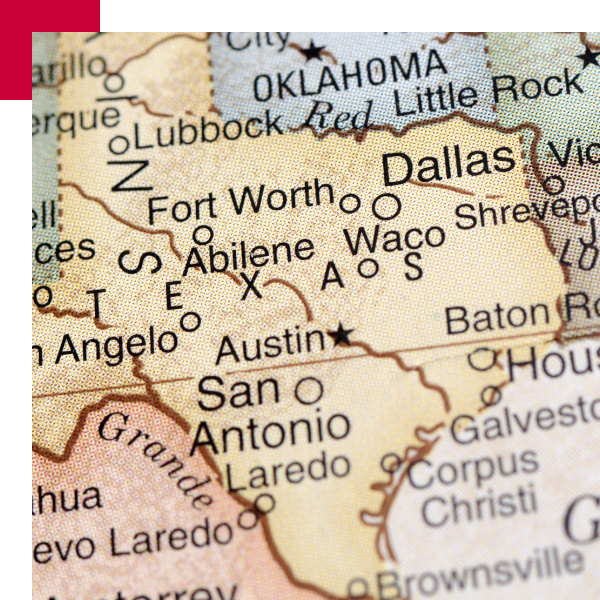

Knowledge of Texas Designations

Texas has 628 designated Opportunity Zones, identified to bolster investment in areas facing economic challenges. Our team is well-versed in Texas’s unique market landscape, ensuring you choose the right location for your investment.

Positive Community Impact

Investing in Opportunity Zones not only provides financial benefits for investors but also fosters significant positive change within communities. These investments can lead to:

- Infrastructure Improvements: Investments often come with enhancements to community infrastructure, including better roads, parks, and public facilities, which contribute to a higher quality of life.

- Access to Resources: With Opportunity Zones, access to essential services such as healthcare, education, and retail improves, benefiting residents and attracting new families.

- Community Engagement: Investors partnering with local leaders and organizations ensure that projects meet the specific needs of the community, fostering a sense of ownership and pride among residents.

- Long-Term Sustainability: By focusing on sustainable development practices, these investments can create lasting benefits that support both the economy and the environment, ensuring that communities thrive for generations to come.

Development Strategies

Developing in Opportunity Zones requires strategic planning and knowledge of local regulations. The Boehm Commercial Group’s extensive experience in Texas Commercial Real Estate means you’ll receive comprehensive guidance every step of the way.

Why Partner with Boehm Commercial Group

Partnering with us means accessing a wealth of resources and expertise.

- • We provide tailored investment strategies that match your goals.

- • Our team has established relationships with local officials and stakeholders.

- • We regularly analyze market data to inform your investment decisions.

- • We’re committed to fostering long-term relationships that benefit the community.

Investing in Opportunity Zones presents a unique chance to make a lasting impact while capitalizing on tax incentives. Let Boehm Commercial Group guide you through the process; together, we can unlock potential in Texas’s most underserved areas. Contact us today to start your journey!