In the wake of the devastating storms and flooding that swept through Central Texas earlier this month, many property owners are still assessing the damage and beginning the road to recovery.

On July 6, 2025, Governor Greg Abbott issued a disaster declaration in response to the severe storms and widespread flooding that impacted much of Central and West Texas. This declaration covers the following 21 counties:

Bandera, Bexar, Burnet, Caldwell, Coke, Comal, Concho, Gillespie, Kendall, Kerr, Kimble, Llano, Mason, McCulloch, Menard, Reeves, San Saba, Tom Green, Travis, and Williamson.

If your home, business, rental, or other property in one of these counties was damaged during the recent flooding, you may be eligible for meaningful property tax relief through a temporary exemption program outlined in the Texas Property Tax Code.

What Is the Temporary Exemption for Property Damaged by Disaster?

Under Texas law, if your property sustained at least 15% damage and is located in a governor-declared disaster area, you can apply for a temporary exemption of a portion of your property’s 2025 appraised value. This tax relief applies to both residential and commercial properties and can help reduce your financial burden as you recover and rebuild.

Eligible property types include:

Tangible personal property used for income production

Improvements to real property (homes, buildings, structures)

Certain manufactured homes

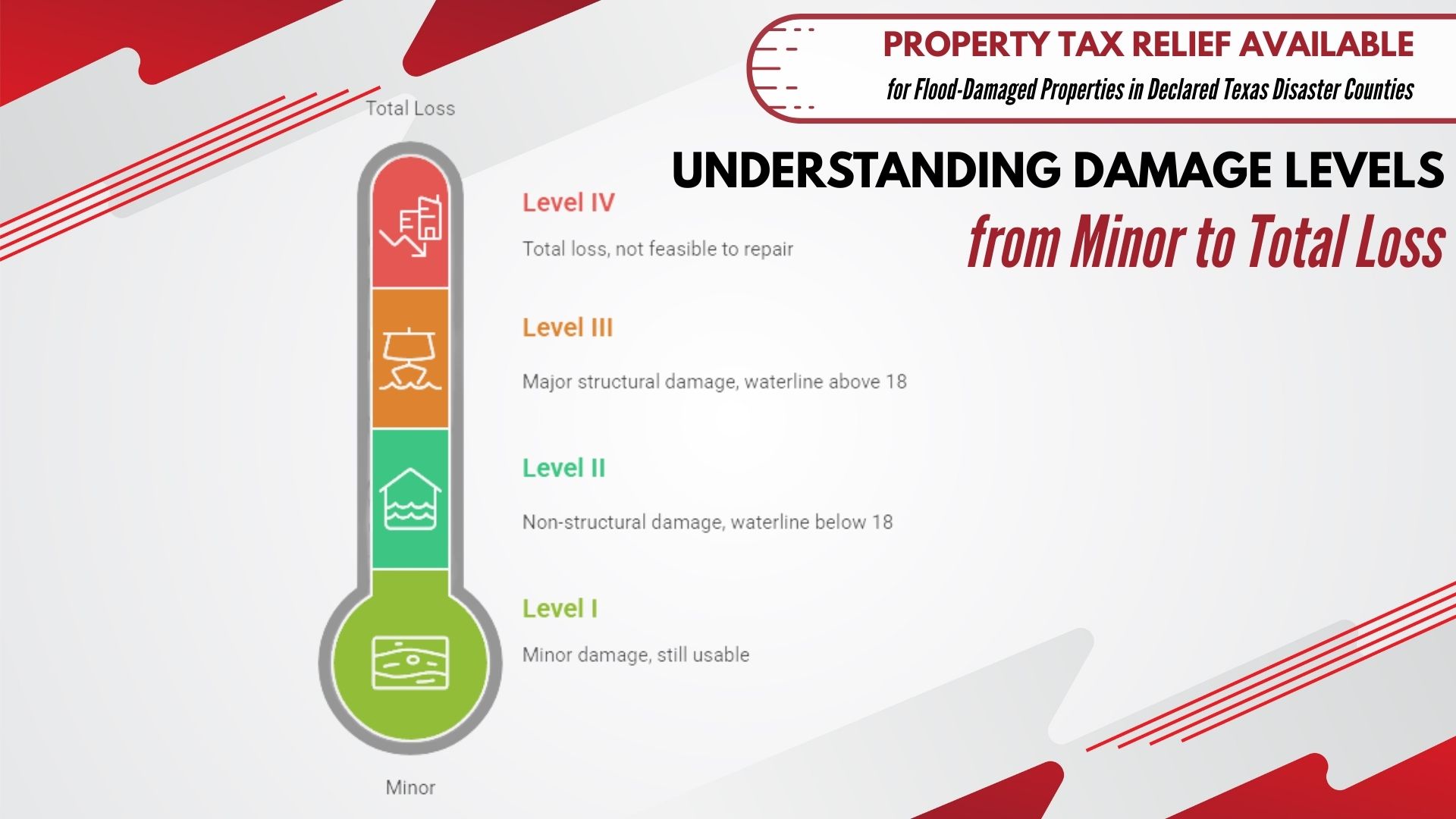

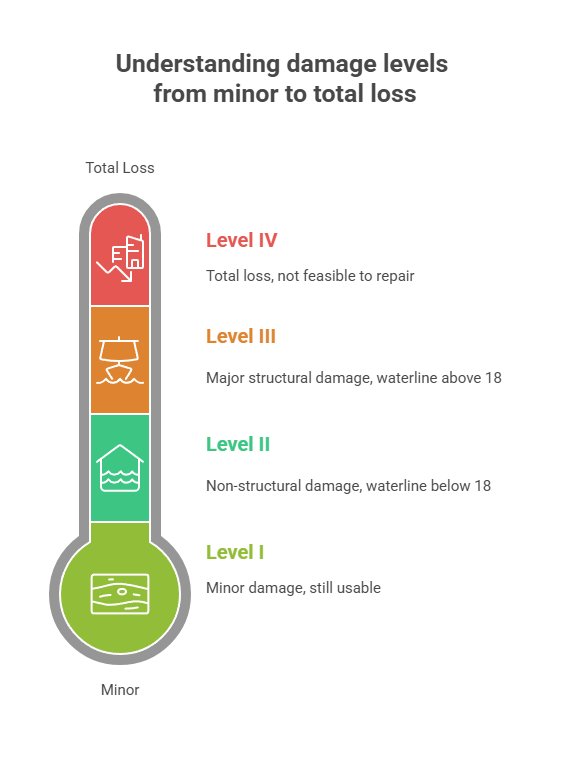

Damage Assessment & Property Tax Exemption Levels

The county chief appraiser will determine the extent of your property’s physical damage and assign a damage level, which corresponds to a percentage of temporary tax exemption:

The percentage will be applied to the current year’s appraised value, offering real savings on your property tax bill.

Level I:

Minor Damage

Damage Range: 15% to less than 30%

Description: Level I damage represents minor issues that do not significantly impair the usability of the affected item or structure. This could include cosmetic damage, minor leaks, or superficial wear and tear. The item remains functional and safe for its intended purpose.

Characteristics:

Superficial scratches or dents.

Small leaks that are easily repairable.

Minor water stains.

Slight discoloration.

Minimal impact on structural integrity.

Example Scenarios:

A piece of furniture with a few scratches on the surface.

A wall with a small water stain from a minor leak.

A vehicle with a dented fender that does not affect its drivability.

Exemption Percentage: 15%

Level II:

Non-Structural Damage

Damage Range: 30% to less than 60%

Description: Level II damage involves more significant issues that affect non-structural components. While the item or structure may still be usable, repairs are necessary to prevent further deterioration or safety hazards. In the context of flooding, the waterline is less than 18 inches above the floor.

Characteristics:

Moderate water damage to walls or flooring.

Damage to electrical systems that requires repair.

Broken windows or doors.

Waterline below 18 inches.

Damage to interior finishes.

Example Scenarios:

A house with water damage to the drywall and flooring after a minor flood.

A vehicle with a damaged interior due to a collision.

Equipment with damaged external components.

Exemption Percentage: 30%

Level III:

Major Structural Damage

Damage Range: 60% to less than 100%

Description: Level III damage indicates substantial structural compromise that significantly impacts the safety and usability of the item or structure. Extensive repairs are required to restore it to a safe and functional condition. In the context of flooding, the waterline is equal to or greater than 18 inches above the floor.

Characteristics:

Significant water damage to structural components (e.g., foundation, framing).

Extensive mold growth.

Compromised structural integrity.

Waterline at or above 18 inches.

Major damage to essential systems (e.g., plumbing, HVAC).

Example Scenarios:

A building with a collapsed roof or foundation damage.

A vehicle with a severely damaged frame.

A house with extensive water damage and mold growth after a major flood.

Exemption Percentage: 60%

Level IV:

Total Loss

Damage Range: 100%

Description: Level IV damage represents a complete loss, where the item or structure is beyond repair and cannot be restored to a usable condition. The cost of repair exceeds the value of the item.

Characteristics:

Complete destruction of the item or structure.

Irreparable damage to essential components.

Safety hazards that cannot be mitigated.

Cost of repair exceeding the item’s value.

Example Scenarios:

A building completely destroyed by fire or natural disaster.

A vehicle that is totaled in an accident.

Equipment that is irreparably damaged and cannot be salvaged.

Exemption Percentage: 100%

Important Deadline: October 20, 2025

Property owners must apply for the exemption within 105 days of the governor’s disaster declaration. That means the final deadline to submit your application is October 20, 2025.

Your Trusted Real Estate Partner

Whether you’re looking for a top real estate agent for commercial needs or exploring opportunities with reputable commercial real estate companies, we are your dedicated partner. Reach out to our team today, and let’s discuss how you can become part of San Antonio’s promising growth story and leverage these developments as catalysts for your next investment.