What Owners Need to Know Before Making a Decision

Texas self-storage remains one of the most resilient commercial asset classes, but outcomes depend on more than demand. These Texas self-storage FAQs address the most common questions we hear from owners who are considering selling, expanding, or simply want clarity on value and market conditions.

The goal is simple: help you make confident, informed decisions.

Why Does Self-Storage Perform Well in Texas?

Population growth, in-migration, and steady renter demand support self-storage statewide. Performance, however, varies by submarket. A Hill Country facility underwrites very differently than an urban or oversupplied market, making local insight essential.

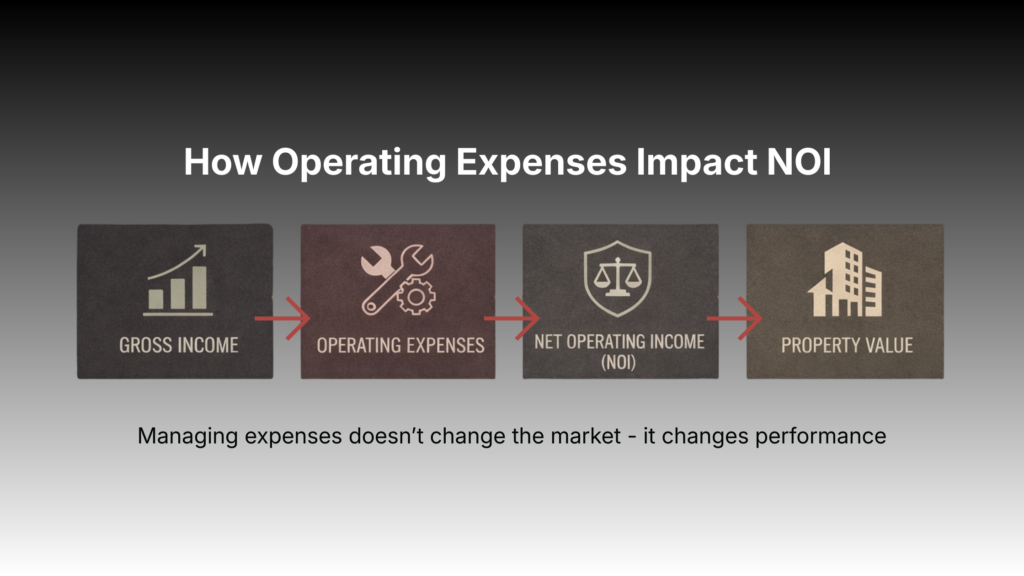

How Are Texas Self-Storage Facilities Valued?

Self-storage is valued primarily on income performance, not just real estate.

Buyers focus on:

In-place vs. market rents

Unit mix and occupancy

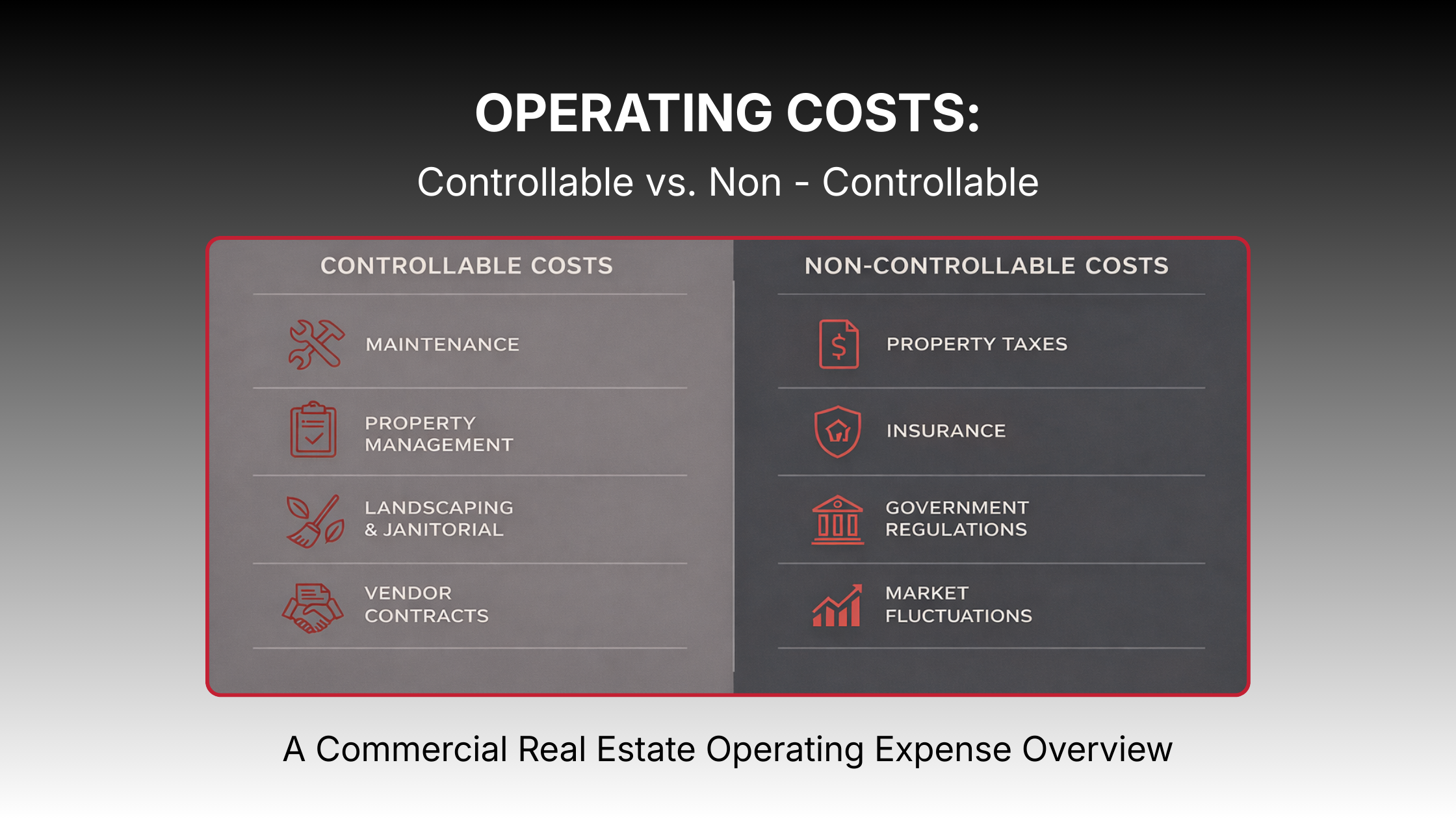

Operating efficiency and expenses

Expansion or value-add potential

Clear data and realistic projections often drive stronger pricing.

Is Now the Right Time to Sell?

There’s no universal answer — only what’s right for your property. Owners should evaluate buyer demand, interest rate sensitivity, capital needs, and whether upside has already been captured. Strategic timing often matters more than market headlines.

For owners actively exploring a sale, understanding the process, timing, and preparation involved can help reduce risk and improve outcomes, which is covered in more detail in how to sell your self-storage property in Texas.

Do Buyers Prefer Climate-Controlled Storage?

Often, but not always. Climate-controlled units typically achieve higher rents, yet well-run non-climate facilities can perform just as well in the right markets. Buyers prioritize profitability and stability.

What Do Buyers Expect During Due Diligence?

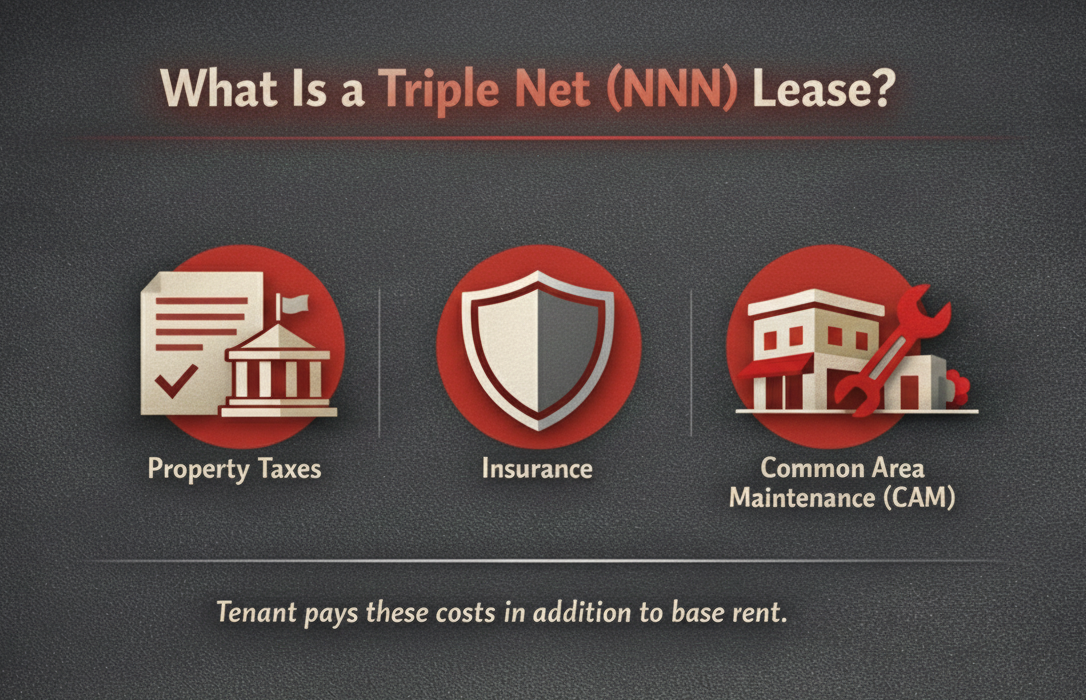

Serious buyers expect clean, organized records, including:

Trailing financials

Rent rolls by unit type

Occupancy and rate history

Utility, tax, and insurance data

Preparation reduces friction and protects value.

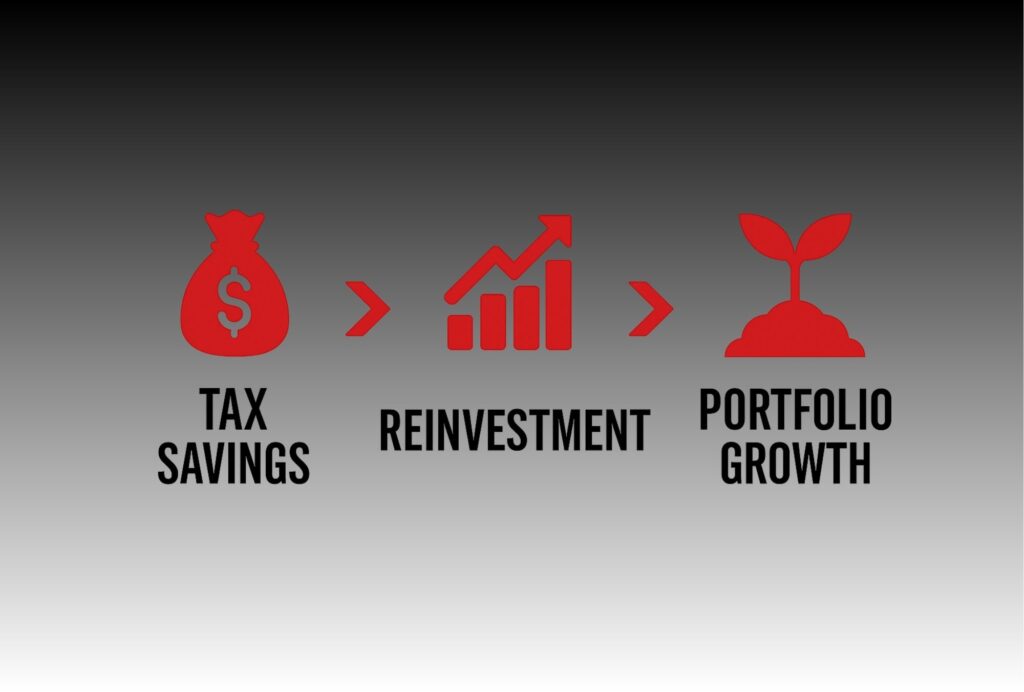

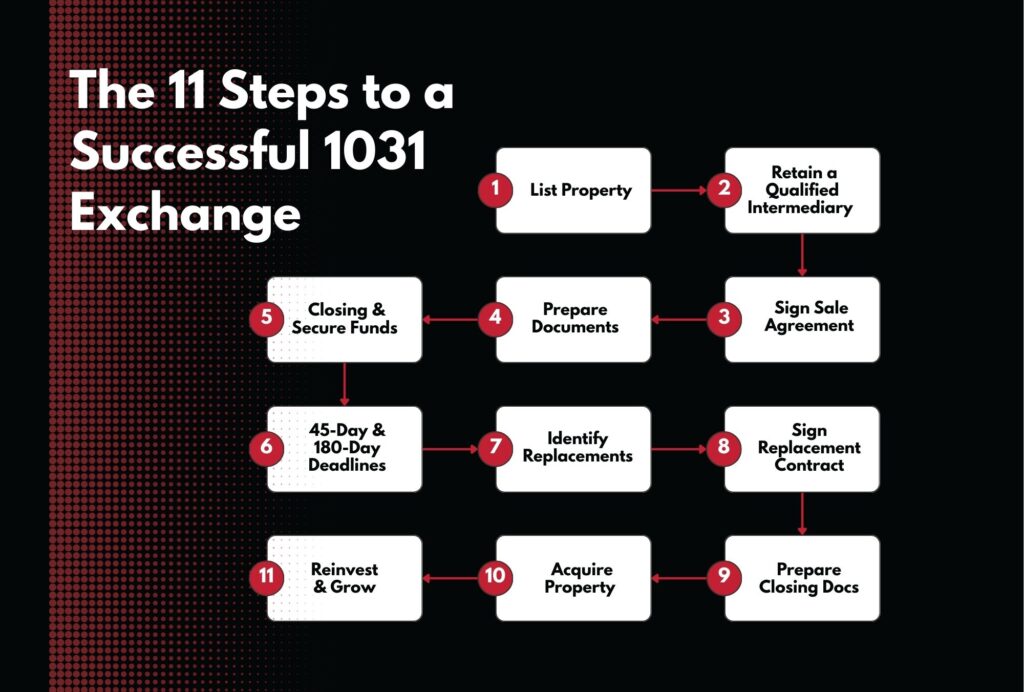

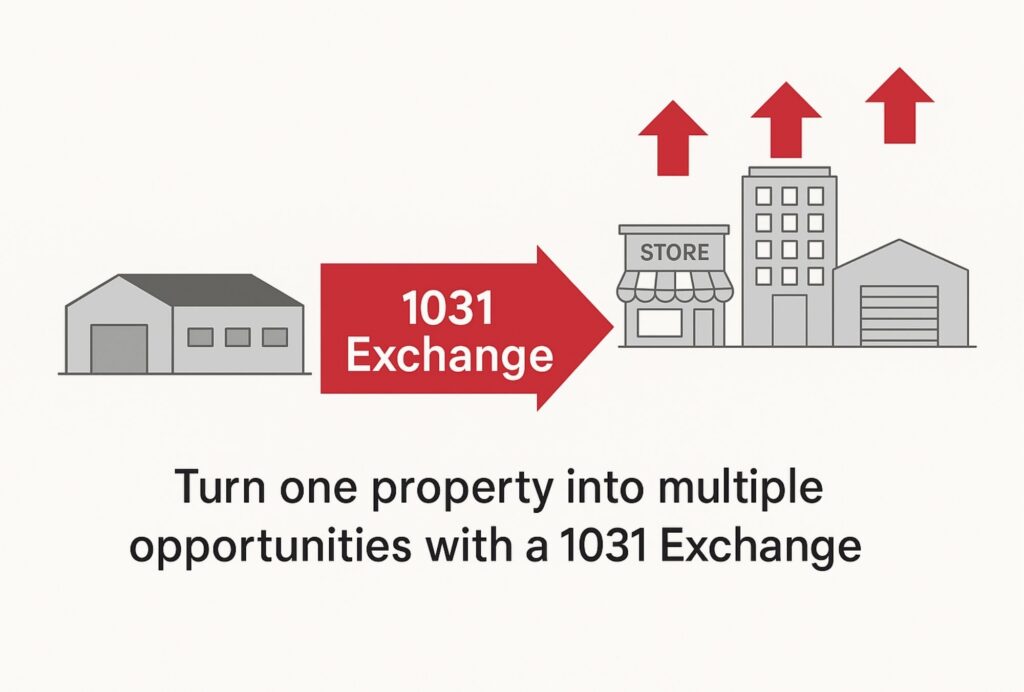

Can I Use a 1031 Exchange?

Yes. Self-storage properties commonly qualify for 1031 exchanges, allowing owners to defer capital gains by reinvesting into other income-producing assets. Advance planning is critical.

Common Owner Mistakes

Value is often lost by:

Pricing off online estimates

Overstating upside without data

Ignoring operational inefficiencies

Using brokers unfamiliar with self-storage

One of the most avoidable mistakes is not understanding what to look for in a self-storage real estate broker before taking a property to market.

Self-storage is a specialty asset. Experience matters.

How Boehm Commercial Group Helps

At Boehm Commercial Group, we advise Texas self-storage owners with clarity, strategy, and discretion. Our role is to help you make informed decisions at every stage of ownership — whether you’re evaluating value, planning next steps, or preparing for a transaction.

We help owners:

Understand true market value and buyer pricing drivers

Evaluate sell, hold, or expansion strategies

Prepare for buyer scrutiny and due diligence

Execute decisions with confidence and control

Implement a World-class, Award Winning Marketing Plan

If you’re asking these questions, you’re already thinking strategically.

If you’re considering selling a self-storage facility — or simply want clarity on value and timing — Boehm Commercial Group provides experienced guidance grounded in real transaction insight.

Your Trusted Real Estate Partner

Whether you’re looking for a top real estate agent for commercial needs or exploring opportunities with reputable commercial real estate companies, we are your dedicated partner. Reach out to our team today, and let’s discuss how you can become part of San Antonio’s promising growth story and leverage these developments as catalysts for your next investment.

Call Us: 830-216-6232

Call Us: 830-216-6232 Visit Us:

Visit Us:  Email Us: Office@glenboehm.com

Email Us: Office@glenboehm.com